What can open banking do for Egypt?

Akram Abdou is the founder of Egypt-based Underlie, an open banking platform offering application programming interfaces (APIs) to banks

Open banking is set to make an economic impact in any country that adopts it. Whether it's customer-merchant transparency or automation, all use-cases of open banking have made a direct impact to any country's gross domestic product (GDP).

Simply put, open banking is the ability for a customer to have full control of their bank account data. This would include two approaches: easily accessing that information, and easily sharing that information. Fundamentally, if data is money, then customers should have the freedom to share that data 'money' with whoever can provide them with financial benefits and services in return.

Open banking has impacted different markets in more ways than one:

- It has developed new industries that haven't existed before (for example leasing economy).

- It shifted financial products to customer-centric products. Which enabled better offerings from banks and fintechs to unbanked, underbanked, and banked consumers.

- It has improved financial literacy where customers have devalued cash as an asset. Empowering the idea of lifestyle banking, where every money movement carries more value to an individual when its online vs offline.

To better understand the impact of open banking we have to look at market trends.

Let us put this in perspective. Here is a list of the 10 most unbanked populations in the world.

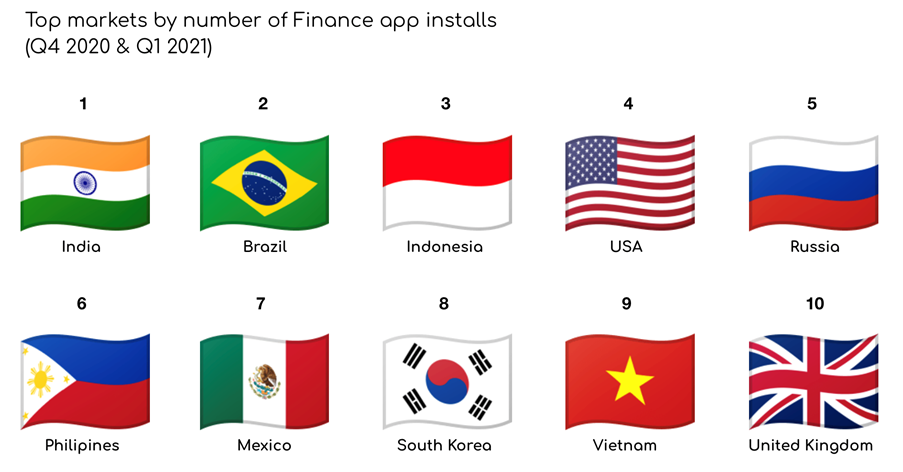

Now lets look at the countries with the highest finance related app downloads.

The trend is obvious, the most unbanked populations needed open banking to create a value proposition for their consumers through customer-centric products and services. Therefore, contributing to more finance app downloads.

The real catch is when we look at the two diagrams above and compare:

- 5/10 countries that are the most unbanked countries, also have the highest number of finance app downloads.

- 7/10 countries with the most unbanked populations have developed regulations for Open APIs to enable the sharing of bank information

- 8/10 countries with the highest app downloads have implemented open-banking through regulations or market activity

These market trends make it very obvious that open banking plays a big role in empowering financial inclusion in any country (developing or developed).

Every country has its own approach to open banking. Whether it is regulator driven or market driven, there is always a way to implement Open APIs in a safe and secure way that enables banks, fintechs, and the customer to benefit from such a paradigm shift.

Wider economic impact

By improving the transparency of current account data, open banking means more third-parties will have access to customer data, which can lead to a reduction in the risk premium currently charged on interest rates linked to products such as mortgages, due to a clearer understanding of a person's underlying credit risk.

We will focus on two different industries in Egypt that will be transformed with an open banking economy. We will use other countries that have adopted this technology and see how this will apply to local use-cases. This will be a problem/solution approach.

Industry 1: Car Leasing/Financing

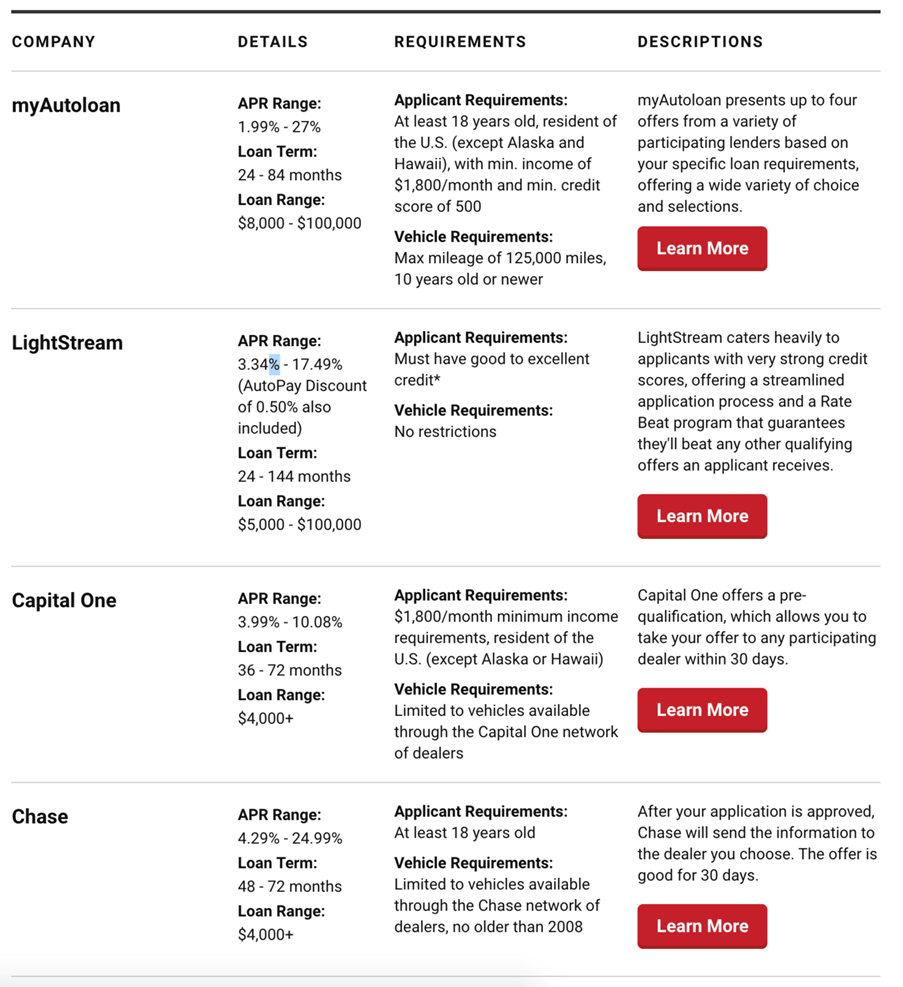

Leasing is essentially long period renting. In developed countries, both banks and consumer finance companies offer customers with different leasing deals depending on the best financial fit. Around 30 per cent of car sales in the United States are leased versus financed/bought. By tailoring the car lease deal based on the customer's financial standing, you lower the barrier for the transaction to go through, which would eventually increase car transactions.

Problem: Currently, there is no significant leasing economy in Egypt. Financing companies take the risk when understanding their customer with their own in-house formulas eg: customer living location to assess credit worthiness.

Solution: By providing customers with an ability to share their bank information, you can accordingly get deals from both the banks and consumer finance companies that better match your criteria. As you can see in the image above, both banks and financing companies can offer competitive deals by having a comprehensive financial understanding of that consumer.

Example country: We saw in developing countries like Nigeria how an open-banking approach has allowed more cars to be leased and financed, further empowering the lending economy in the country.

Industry #2: Real estate rentals/installments

The real estate market in Egypt is currently booming. With multiple projects developing, and brokers always looking to capture customers, there is a need to ease the transactions of the influx of demand coming in. For developers and real estate companies to propose rental and sale agreements, they need to fully understand a customer's financial capability. Furthermore in Egypt, card payment fees are 20x more expensive than bank transfers.

Problem: Real estate companies are currently offering long payment periods to entice customers. The approach has been widely used but isn't necessarily the financial burden that consumers want to bear.

- Real estate companies don't have a sense of a customer's financial health, making it hard to offer a tailored deal to a customer.

- Egyptian agents are now offering card payments for financing and rental terms. Making fees too expensive for customers when bank payments should be an option.

- Currency inflation could contradict installment interest rates if contracts are binding for such long periods.

Solution: Using a standardised open banking platform, customers can securely share their bank account information with a real estate company.

- Real estate companies will be able to attract customers in a better way by providing a tailored deal for their customers’ current financial standing.

- Transaction fees will be lower because they will be utilising bank-to-bank payments for all customers depending on their bank of choice.

- Realtors will try to absorb bigger first installments to reduce longer period payment risks associated with interest rates.

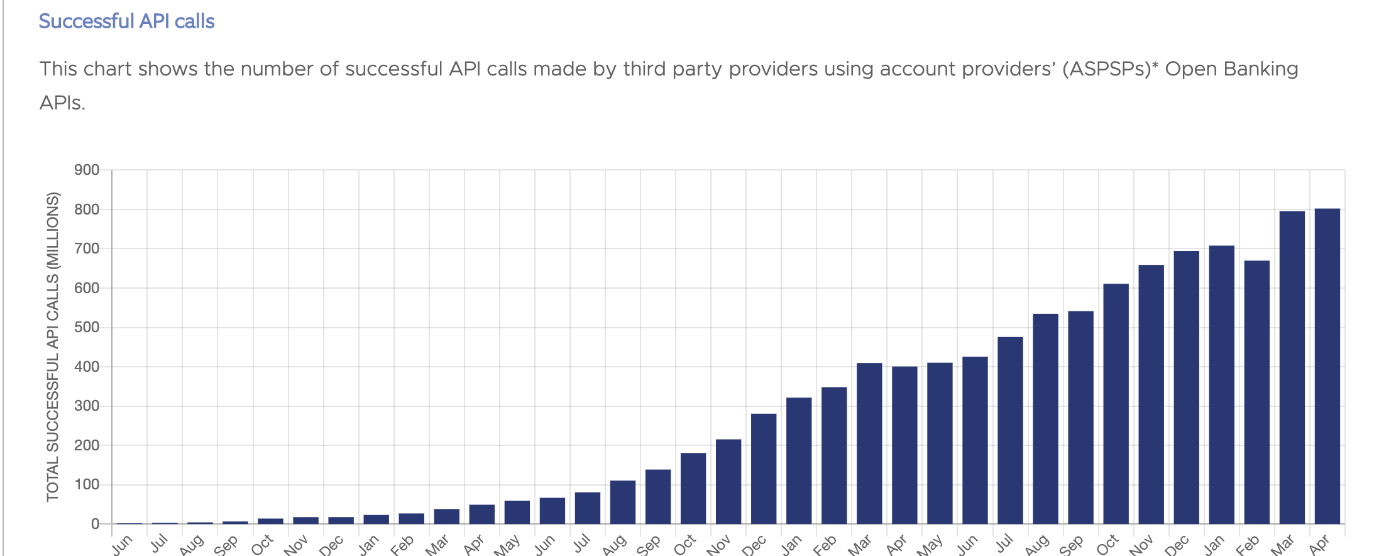

Example country: The UK has found great success with banks monetising customer data by selling deeper insight and analytics capabilities beyond what is required by regulation. This has increased API call offerings and allowed most real-estate deals to include an open-banking decision maker. After three years, the UK has over 800 million successful API calls happening every month where banks can monetise on each one.

At Underlie, we offer 25+ different API calls for banks to utilise and monetise their data. Allowing a secure transfer of information from banks to share with automobile and real estate companies in the market who can offer customer-centric products to Egyptian consumers.