Desado announces investment from iMENA Holdings; how does it stack up in flash sales?

It’s been said that there needs to be more linguistic creativity

when it comes to branding in the Arab world.

The announcement of Desado’s

investment from iMENA Holdings, just days after Wysada

announced investment from MENA Venture Investments, hardly

refutes that point. Two MENAs (both investment vehicles based in

Amman), two trisyllabic flash sales sites.

But don’t confuse either party with the other- rivalry between the

two e-commerce sites has been running ever since both

launched within days of one another last December.

(Disclosure: Wamda Capital shares investment and management

resources with MENA Venture Investments. Neither were consulted for

this article.)

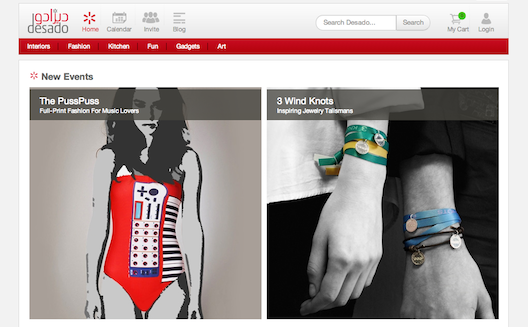

Both sites sell similar goods; Amman-based Wysada is perhaps a bit

more squarely focused on home goods (gadgets, accessories, kitchen

and dining goods, and furniture), while Dubai-based Desado offers a

mix of home wares, fashion, fun, “quirky” design items, gadgets,

and items for kids and pets, founder and CEO Muhammad Chbib

explains.

Of course, no current e-commerce site will say that rivalry a bad thing in a new sector. "We don't feel any rivalry. On the contrary, I think it's good to have other concepts around as well because we benefit from each other," says Chbib. "We have actively reached out to Wysada to establish a rapport and exchange ideas."

Yet how the two are stacking up against each other will reveal

what's working in the home goods sector. And when it comes to

assessing what works, neither company is overly candid about its

metrics.

In our brief chat last week, Wysada

portrayed itself as steadily fulfilling demand. Customers are

happy, Wysada's regional marketing manager said- 30% of its buyers

are repeat customers, and 60% of its inventory are repurchases. The

company is focusing on building its own brand, to serve a need it

perceives in the market for larger furniture goods, while

implementing tag sales (sales curated by famous tastemakers) to

boost the popularity of its kitchen goods segment.

Desado, on the other hand, seems to be banking on the idea that it

is focused on demand creation- serving customers things that they

didn’t even know they wanted. "We are a discovery platform,” Chbib

repeats. “You don't know what you want, and you come to Desado and

you find things you've never thought of. 90% of what we do isn't

branded. We’re trying to make people aware of design as a

concept.”

The goal is aspirational- to educate the market not just about

shopping online, but about appreciation of design. Yet Chbib has a

point that

demand creation (making customers desire something they didn’t

know they needed) can be a much more powerful position to be in,

and potentially more

profitable, than demand fulfillment (catering to existing

market needs).

But. It’s difficult to assess how well a company is succeeding at

either, without data.

Desado was not forthcoming about customer satisfaction metrics,

aside from revealing that for its repeat customers, the time

between first and second orders has decreased from 30 days to 3 to

4 days. Wysada reports an average of 5 days between orders for

repeat customers lately, but, without any information about the

sample sizes, the two data points cannot be compared.

“Already a significant amount of customers have placed over 10

orders, and a few have placed over 30 orders, which I've never seen

in the Middle East.” Chbib clarifies amusingly, “those are not

internal customers."

Of the 250 sales events Desado sees per month, around 85% of orders

are fulfilled within a given month. 90% of orders are done via

consignment. “We don’t purchase inventory at this stage,” Chbib

describes. “It’s too dangerous, as we don’t have enough data to

understand customer needs yet.” By the end of 2013, he says, the

picture should come into focus.

This rule goes for most of the site’s statistics, he says; too early to discuss. The site is clearly experimenting with a range of verticals. “Designers change from month to month, as we’re trying out new things,” he says, and yet the company is sticking to certain percentages; 25-30% of its sales come from “quirky, fun items,” while only 10% comes from branded fashion. (Harir, which is experimenting with a mix of 50% global brands and 50% local designers, and also trying to up consumption of “quirky,” unique items, may be interested in these numbers).

Another aspect that Chbib insists is unique about Desado is its

focus on data. “We’re a very data-driven company. The depth of

where we go is the most unique thing. I can't claim that it's

revolutionary, but I haven't seen anything like it in the Middle

East,” he says. “We make educated decisions rather than rely on gut

feelings.”

Again, it’s hard to assess the validity of a claim without access

to details. Customizing the home page based on a viewer’s gender,

segmenting newsletter delivery times based on the times that

customers open their emails, and tailoring newsletters based on a

customer’s preferred categories are the only examples offered.

Yet, whatever they're doing, Chbib insists, “I wish that more

e-commerce companies were doing it our way, because then the sector

would be more advanced."

We await comment from others on their analyses.

In any case, Desado is staying focused, says Chbib, on the basics

that make or break an e-commerce site: honing its supply chain, and

offering variety to attract and retain customers; its new round of

investment will help both goals. The company has already launched

its own last mile logistics in the UAE and, like Namshi,

MarkaVIP,

and

Harir, hopes to launch a similar service in Saudi Arabia this

year (its delivery serves the GCC).

It will also go mobile. “We’re looking heavily into it,” Chbib

exudes. “Over 30% of our traffic is from mobile. It’s the future of

our business.”